If you've worked with QuickBooks, you won't be surprised to hear that the Item list is a key piece of your QuickBooks accounting system. The Item list identifies each of the things that you sell. The Item list also identifies other things that appear on your invoices and—if you use them—on your purchase orders.

I talk about how you work with the QuickBooks Item list: more specifically, how you look at and use the information on the Item list. I explain how to add information to the list and how to edit information already on the list. What's more, I talk about three accounting tasks that are related to your Item list: adjusting physical inventory accounts for inventory shrinkage or spoilage; adjusting price levels of your inventory items; and if you manufacture inventory, how the new version of QuickBooks handles manufactured goods.

Looking at Your Item List

QuickBooks provides a bunch of different ways to see the information that you've stored in your Item list. You may already know some of this stuff if you've worked with QuickBooks a bit. Some of it may be new to you. In any case, the next sections review the half-dozen ways that you can see the items on your Item list.

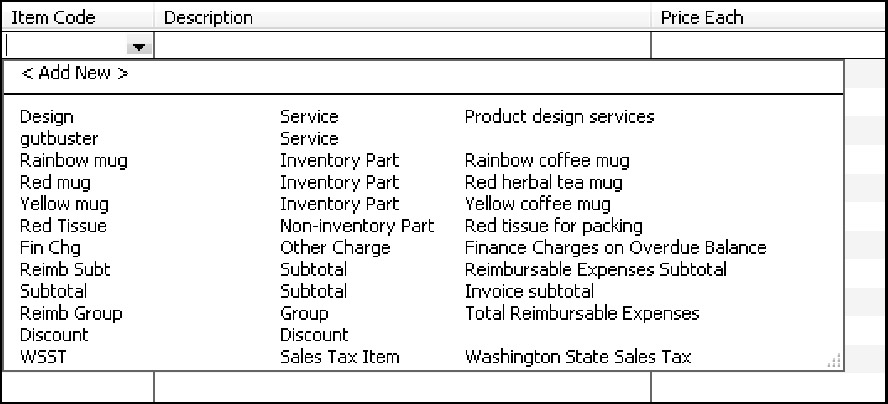

Using the Item Column

One important point to consider as you look at the Item column and Item drop-down list in Figure 1 is space. Note that the Item drop-down list is pretty narrow. Note also that the Item drop-down list in Figure 1provides the item code (the left column), the item type, and an item description. The item description—if the description is lengthy—is cut off. You'll want to remember this seemingly trivial but important point as you work with your Item file. You want descriptive item codes and, if possible, brief descriptions.

| Tip | I'm using pretty self-explanatory item codes in this reference, as you can see from Figure 1. In real life, your codes may be far more cryptic. |

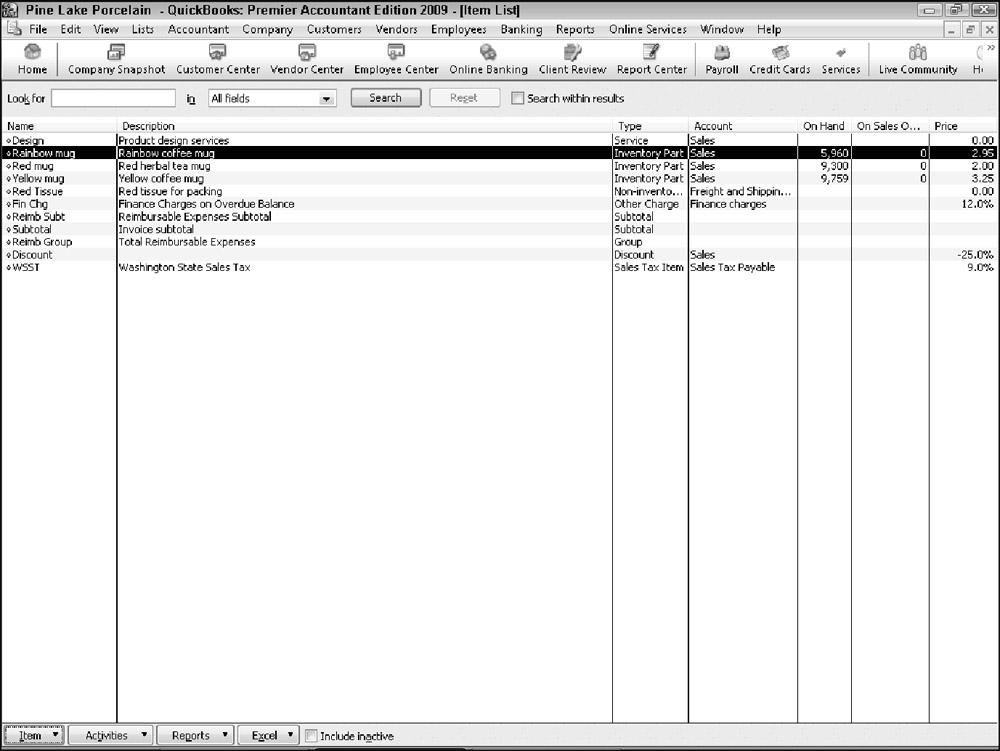

Using the Item List Window

If you choose the Lists ð Item List command, QuickBooks displays the Item List window, as shown in Figure 2. The Item List window identifies the item code or name, the description, the type of item , the account that gets credited when you sell some of the items, and the inventory stocking and pricing information (if you supply that).

The Item list provides a good way to quickly see what items you can put on invoices and purchase orders. The Item list also provides a quick and convenient way to see the stocking levels and prices.

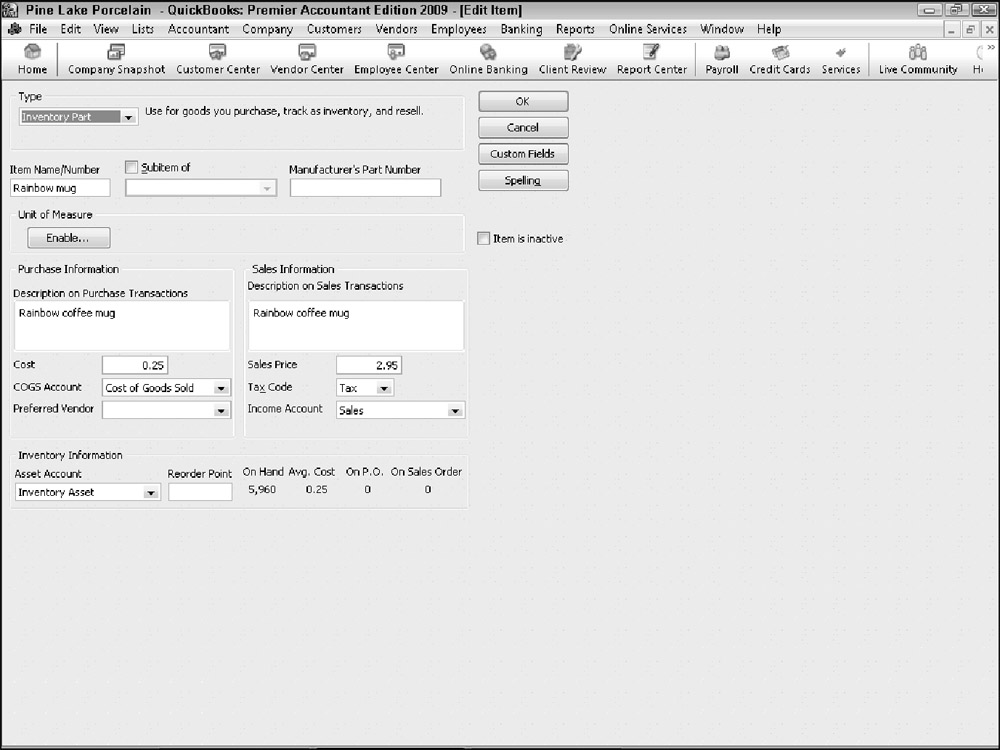

If you want more information about an item shown in the Item List window, you can double-click the item. When you double-click the item, QuickBooks displays the Edit Item window, as shown in Figure 3. Essentially, the Edit Item window displays all the information available about a particular item. You can use the Edit Item window to change bits of item information.

Using the Inventory Reports

I mention one other thing because it's so darn useful. As you would expect, QuickBooks supplies several interesting, useful inventory reports. If you choose the Reports ð Inventory command, for example, QuickBooks displays a submenu of inventory reports. The submenu provides reports that give inventory valuations, inventory stock levels, and a worksheet that you can use to go out and physically count the inventory on store shelves or in the warehouse.