Most of the time, line items that appear on an invoice are items that you have described in the item list and then quantify directly on the invoice. However, in some service businesses, you may actually sell many units of the same item. For example, a lawyer may sell hours or partial hours of legal advice. This may be all that she sells. A CPA may sell hours of consulting or accounting or tax preparation work.

In these circumstances, you don't want to have an invoice go out to the customer with one line on it that says, for example, "legal services, 100 hours, $20,000." You instead want an invoice that details each of the tasks that the lawyer performed: estate planning for 1.5 hours, review of a contract for 4 hours, preparation of a new real estate lease for 2 hours, and so forth. To provide this level of detail — detail that is really beneath the item — you use the QuickBooks Time Tracking feature.

QuickBooks supplies two methods for tracking the time spent that will be billed on an invoice as an item. You can use the weekly time sheet or you can time or record individual activities. I briefly describe how both time tracking methods work — neither is difficult. Professional service providers — such as accountants, attorneys, consultants, architects, and so on — should consider using one of these features to make sure that they accurately keep good records of the time spent working for a client or customer.

Using a Weekly Timesheet

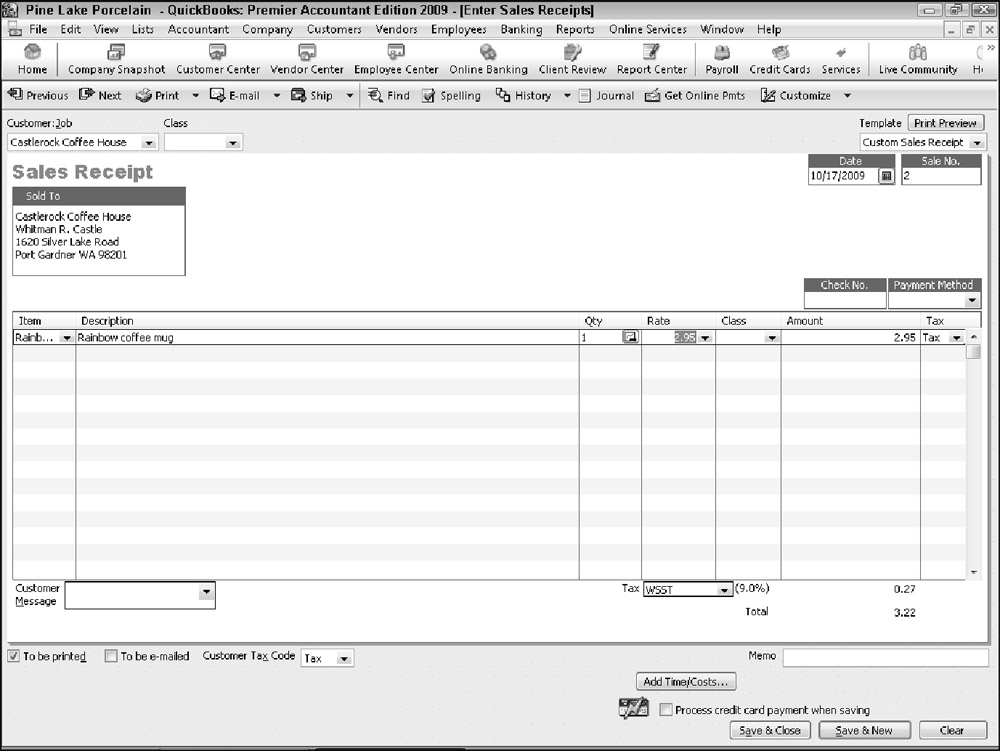

To use the weekly timesheet method, choose the Customers ð Enter Time ð Use Weekly Timesheet command. QuickBooks displays the Weekly Timesheet window, shown in Figure 1. To use the Weekly Timesheet window, first use the Name box to identify the employee or vendor or other person performing the service. You should be able to select this person's name from the Name box. If you can't select a person's name from the Name box, enter the person's name into the box, and then, when prompted, tell QuickBooks which list (employee, vendor, or other names) should be added. After you've added the name of the person performing the work, use the columns of the Weekly Timesheet window to describe the customer or job for whom the work has been performed, the service code, a brief description or note, the payroll item (if you're using QuickBooks for payroll), the class (if you're tracking classes), and then the hours spent per day. You can enter as many lines onto the Weekly Timesheet window as you want. Each line appears separately on an invoice. The notes information appears in the description area of the invoice. For this reason, you want to use appropriate and descriptive notes.

Timing Single Activities

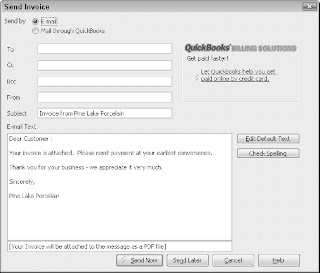

If you want to record service activities as they occur, choose the Customers ð Enter Time ð Time/Enter Single Activity command. QuickBooks displays the Time/Enter Single Activity window, as shown in Figure 2.

To time or record a single activity, record the activity date into the Date box. Use the Name box to identify the person performing the service. In the Customer:Job box, identify the customer or the job for which the service is being performed. Select the appropriate service item from the Service Item drop-down list and the appropriate payroll item from the Payroll Item drop-down list. If you're tracking classes, predictably, you can also use the Class drop-down list to classify the activity. The Notes box should be used to record a brief appropriate description of the service. This description appears on the invoice, so be thoughtful about what you write. After describing or providing this general information about the service, you have two ways to record the time spent on the service:

-

Manually record time: You can manually record the time spent on an activity by using the Duration box to enter the time. If you spent 10 minutes, for example, enter 0:10 into the Duration box. If you spent 3 hours and 40 minutes, enter 3:40 into the Duration box.

-

Have QuickBooks record the time: You can also have QuickBooks record the time that you spent on the activity. Just click the Start button in the Duration box when you start the activity, and click the Stop button when you stop the activity. If you want to pause the timer (while you take a phone call, for example) click the Pause button.

After you describe the activity you're performing in the Time/Enter Single Activity window, click the Save & New or Save & Close button to save the activity information.

| Tip | Verify that the Billable check box is selected. The Billable check box appears in the upper-right corner of the Time/Enter Single Activity window. By selecting the Billable box, you tell QuickBooks that it should keep this record of a billable activity for later inclusion on an invoice. |

| Tip | You can use the Previous and Next buttons that appear at the top of the Time/Enter Single Activity window to page back and forth through your records of activity timing. Note, too, that the Spelling button is also available on the Time/Enter Single Activity window. You can, therefore, click the Spelling button to spell check the notes description that you enter — which is a good idea because this information will later appear on an invoice. |

| Tip | QuickBooks also allows your employees to enter their time directly. Choose the Customers ð Enter Time ð Let Employees Enter Their Time command to get information about how this Web service works. |

Including Billable Time on an Invoice

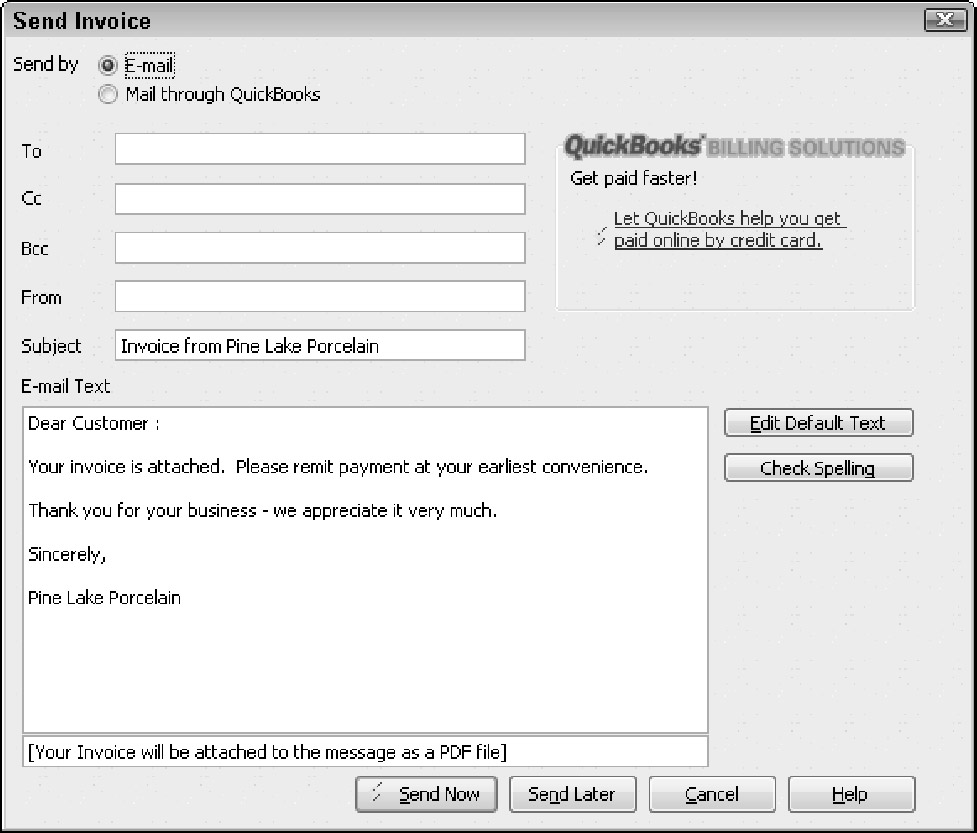

To add billable time and cost to an invoice, create the invoice in the usual way, as I describe previously. After you identify the customer (and if you've entered time for the customer), and if you've been tracking time or costs for the customer, QuickBooks will ask if you want to bill for any of the time or costs using a message box. If you indicate "yes," QuickBooks displays the Choose Billable Time and Costs dialog box shown in Figure 3. The Time tab of the Choose Billable Time and Costs dialog box shows each of the times that you've recorded for a customer. To add these times to the invoice, click the Use column for the time. Or, if you want to select all the times, click the Select All button. Then click OK. QuickBooks then adds each of these billable times as lines to the invoice. Figure 4 shows how billable time information appears on the Create Invoices window.